How to Structure Your Client Advisory Services

(The Easy Way)

Automation, AI, and Bots, will all play a larger role in the tax & accounting industry over time.

How can you compete with “the machines?”

Go deeper with clients.

Every client is a unique human being with unique fears, concerns, and progress they want to make in their life and career.

Machines are great at automating calculations and now even answering questions.

But they can’t:

- Listen to a client and hear the fear in their voice

- See their excitement over a new business idea

- Comfort them when they’ve experienced a loss

- Give them confidence through encouragement and coaching

These are all intrinsically valuable things only you can do as your client’s human advisor.

These actions may seem “touchy-feely” on the surface, but this is the exact value your best clients will be happy to pay you, for a long time.

The human-to-human connection is powerful.

But for that connection to be monetarily valuable, it needs to be combined with strategies and implementation that help clients make progress in their lives and businesses.

| Firms that go deeper with their clients and combine human-to-human connection with strategic advisory work are the firms that will generate the highest value in the future. |

But here’s the catch:

If you’ve been a tax and accounting professional for some time:

- Your formal training probably didn’t include how to provide

“client advisory services”.

- You’re not sure how to price or get paid for that type of work.

- Even if you’re already offering strategic advisory help to clients, you don’t have a structured process that anyone on your staff can follow to guarantee the best results.

How Do You Fix This in Your Practice?

You need a simple Client Advisory Workflow you can follow with every individual or business client you work with.

Just like you have a tax & accounting workflow, you need a simple Client Advisory workflow if you want to scale that side of your business.

And it needs to account for the critical elements, in the right order, so clients will be happy to continue to pay your fee.

What Happens When You Nail the Right Client Advisory Workflow?

- You’ll feel 100% confident offering Client Advisory Services in today’s “AI” world.

- Clients will feel that confidence and want to work with you.

- You’ll have a unique process other firms don’t have, so you’ll stand out from the competition.

- Clients will understand your value and be willing to pay your fees.

- You’ll feel zero stress when you engage a new client because you’ll know step-by-step exactly what needs to happen.

To help you create the perfect Client Advisory workflow for your practice, we want to give you The Easy Client Advisory Worksheet©

It’s been used by small firm owners who are already offering profitable Client Advisory Services, so you don’t have to reinvent the wheel.

You can just use a process that’s already proven to work.

Why This Worksheet?

We’ve been working with small firm owners for over 14 years helping them increase their margins and attract higher-paying clients.

Our team has a deep knowledge and history with Strategic Advisory work and we documented the pattern of how firms create repeatable results with their clients.

We’ve studied this pattern thousands of times, with firms across all 50 states.

Now any firm, regardless of size, can follow this pattern and successfully implement

Client Advisory Services in their practice.

Key Elements of the Worksheet

The Easy Client Advisory Worksheet© has 5 specific elements you’ll need to execute to

in your practice:

- Engage for Advisory level work

- Understand what progress this client wants to make

- Define their current starting point

- Create an action plan to help them move forward

- Work the plan and adjust

Let’s break down each element.

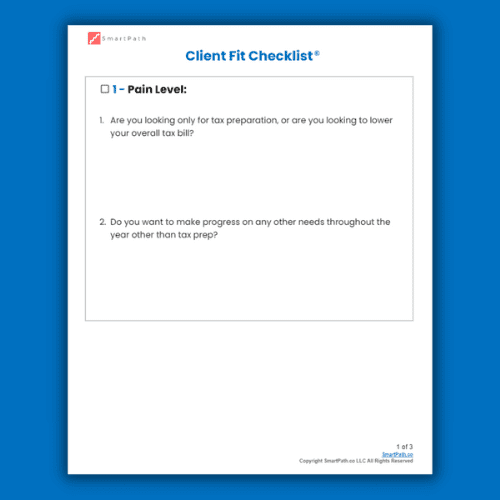

1 | Engage for Advisory Level Work

This one sounds like a no-brainer but it’s important not to skip.

The first step in your Client Advisory flow should be ensuring you’re getting paid for this level of help.

Many times we love our clients and just want to dive in when they have a “quick-question”.

But if answering that question falls out of their current scope, then you’ll want to make sure you update their engagement to get fairly paid for your strategy.

How to do this in your practice:

- If the client wants or needs strategic planning and not just tax prep or basic accounting, have a higher level of engagement ready to offer them.

(You can see how to do this on our blog or use our Engage Software to do it for you). - Ensure your pricing aligns with all the knowledge and expertise you’re deploying on behalf of the client, not just your labor.

- Across the US Strategic Advisor Engagements average between:

$59 -$599+ per month for Individuals.

- $199-$4,999+ per month for businesses.

- The specific price should be based on the complexity of the client.

- Enroll the client in your higher-level package.

-Get all your paperwork signed and collect your first month’s payment BEFORE you begin work for that client.

2 | Understand What Progress This Client Wants to Make

Here is where we really stand out from the “machines”.

Have a human-to-human conversation with the client about what they really want most in their life and/or business.

It can be hard to identify what that “thing” is for many people.

But you can get there if you have someone on your side who’s objectively helping you.

This is why advisors exist.

Not to tell you what to want. Or judge you for what you want.

But to help you figure out what you want and then help you figure out how to get it.

That’s what Client Advisory Services are at the core.

Helping your clients get what they want, faster, in exchange for money.

You don’t need any federal or state licenses and you don’t need to go back to school for years to help your clients strategically.

You simply need to use your existing knowledge and expertise and follow a defined process for every client.

No need to overcomplicate it.

If you make it complicated, it will take forever to help clients start to make progress. And clients will be intimated and won’t want to participate.

How to do this in your practice:

- Have the client identify at least 3 things in their personal or business financial life they want to make progress on.

- Document how making progress on these things will make their life better. (What will the impact be when it’s achieved?)

- Make it measurable. If someone wants to feel less stressed about their cash flow, that’s a great goal, but it’s not measurable. How much money will they need to see in their operating account to feel less anxious?

- “Maintaining a balance of $50k in your Chase Checking for 3 months”,

is measurable.

NOTE: If the client’s goals are to “rebalance” their investment portfolio, or get recommendations for what stock to buy – you’ll need to be securities licensed or refer them to someone who is.

This Easy Client Advisory Worksheet© is designed to help you with the basic strategic planning needs that impact a client’s life and business. It is NOT designed to help you give investment advice.

3 | Define The Clients Current Starting Point

Everyone starts somewhere.

Your role as a strategic advisor is to help the client make progress moving forward from wherever they currently are.

So the next step in your Client Advisory workflow is to document objectively, where they are so you can track their improvement.

Just like when you go to the Doctor and the first thing they do is check and record your vitals so they have an objective measure of how healthy you are.

How to do this in your practice:

Define the client’s KSI’s (Key Success Indicators).

These indicators will be unique based on if you’re looking at the client personally, or if you’re looking at their business.

Some Examples of Personal KSI’s

- Monthly Cash Flow/Budget

- This will tell you how much free cash flow someone has to put toward their goals and what can be adjusted to improve their cash flow.

- Personal Balance Sheet/Net Worth

- This will tell you if the client is trending up or down in overall health compared to two specific moments in time.

Some Example Business KSI’s

- Profit Margin

- This will tell you which products or services are most profitable for a client and could lead to more or faster growth if they focused on selling more of these items/services.

- Cash Position

- This will tell you how much free cash flow a business is generating that can be used for growth. And what the business should do with the cash that will help them make the most progress.

These are just a few examples of KSI’s you can help clients calculate to define where they are now and what needs to happen to improve them.

You may have additional KSI’s overtime that you want to track and manage. That’s great – just make sure you account for them as part of your defined workflow.

If you need help with this, you can access simple tools and visual reports through the SmartPath training portal.

NOTE: None of these KSI’s are tied to the client’s investments. This is not financial planning or investment advice. All of these numbers can impact a client’s tax strategy. This is the simple help that no one else in the client’s life will be able to execute.

4 | Create an Action Plan to Help the Client Move Forward

Once you know a client’s goals and their objective starting point, you’ll begin to see what needs to happen so they can make progress.

Here are some common examples:

- They need to eliminate some monthly expenses so they can start putting more money into a tax-advantaged retirement or education account.

- They need to implement tighter accounting processes in their business so they can start tracking their profitability and expenses per item or service they offer.

- They have equity in their home but also carry high-interest credit cards so they need to consolidate that debt into a 2nd mortgage that may have deductible interest or at least allow them to lower their payments.

- They have plenty of free cash flow in the business, so they need to create an expansion plan for what it would cost to open a 2nd location.

If the client wants to realize the benefit, they need to implement all these things with a certain level of complexity in real-life.

Helping the client Implement these solutions can be part of your fee and is one of the reasons why you’re more valuable than AI.

How to do this in your practice:

- There could be a million things the client needs to do. Focus on just 3 more impactful things at a time. When those three are done, pick up three more.

- For every action that needs to happen, define who will be responsible to get it done (you, the client, or a 3rd party) and document who that person is.

- For every action that needs to happen, define a due date for when it needs to be completed and document that due date.

5 | Work the Plan and Make Adjustments

The client’s life will change over time, and their goals and priorities will naturally change.

To ensure ongoing engagement, you need to keep their action plan up to date and make changes as they complete tasks or require adjustments.

This is also where you can “throttle” your fee level over time.

If the client wants to work faster and complete more action items in a month with your help, then you can “throttle up” and increase your fee for a time.

If they are in a maintenance phase of their life and don’t need as much help, you can “throttle down” your fee for a time.

Life happens, and we need to make sure we’re accounting for it as part of our action plan.

How to do this in your practice:

- Keep a shared record of the action plan for each client and document when you check off action items.

- This will show the pace and quantity of work you’re completing for your fee.

- When it’s time to make adjustments to do more or less work, you’ll both have a starting point to design the new level of engagement – do we need to do more or less and what will that look like from a cost perspective?

If you need help creating a shareable action plan for clients, reach out and let us know, we can help.

Quick Review

To help clients strategically and show them you’re more valuable than “AI”, use the

The Easy Client Advisory Worksheet©

- Just like you have a workflow for taxes or accounting, you need a workflow for your Client Advisory Services.

- You already have knowledge and expertise you can apply to any client situation, you just need a process to follow to make it scalable in your practice.

- Keeping your advisory process simple can help you create a ton of value for clients and receive fair compensation for your assistance.

- The 5 Key Principles in your advisory worksheet should be:

- Engage for Advisory level work

- Understand what progress this client wants to make

- Define their current starting point

- Create an action plan to help them move forward

- Work the plan and make adjustments

Next Steps

You don’t have to implement this on your own…there are two ways we can help.

- Click below to download The Easy Client Advisory Worksheet©

If you want to fully automate Client Advisory Services in your practice, but just don’t have the time to do it yourself – we have templates, calculators, and simple 1 page reports that will do 99% of the work for you. (Learn more here.)

William Hamilton is the Founder of SmartPath.co

Over the last 14 years, they have helped 1,000’s of Tax Pros perfect their pricing so they can focus on work they enjoy.