When someone asks what you charge for a tax return…

We’ve been there, we’ve heard it a million times. “I only have a W-2, how much is that going to be?” or “I have a pretty basic return, how much is it going to cost?”

These calls, texts, and emails, can be maddening.

People want a price right away but you can’t quote them without knowing the full picture of what’s actually going on in the client’s tax life.

The client thinks they have a “simple” return when in reality they’re earning income in multiple states, have business income that needs to go on a Schedule C, and have six different stock trade accounts.

Add to that, you rightly don’t want to waste time on “tire-kickers” which will be a pain to work with.

So what’s the best answer?

You need to test the client first.

Most firms just jump into a price conversation, or worse, offer a free consultation without first understanding who this client is and what motivated the call.

This is treatment without diagnosis = malpractice.

If you test the client first, you can know:

- What is their current pain level?

- Are they willing to let you diagnose their pain to discover the best treatment options?

- Is this a human being you even want to work with?

What happens in your practice when you start testing potential clients?

- You can stop wasting time on clients that just want the lowest possible tax return and aren’t looking for a long-term relationship.

- You can know before you quote which clients will be willing to pay premium-level fees that will give you higher margins.

- You can stop feeling like you need to “sell” every client and just hand-pick the ones you really want.

There’s a simple 3-part structure you can use to test the client.

We call this structure the Client Fit Checklist©

It’s one of the first things we implement with a firm when they’re ready to start attracting

ideal clients, instead of just working with anyone.

It’s been tested by small firm owners across the US already who were done giving away free work and wanted to be fairly compensated.

Why This Checklist?

We’ve been working with small firm owners for over 14 years helping them implement better pricing and increase their margins.

Eventually, a pattern emerged that showed the things you need to find out about clients to see if they’re truly right for your practice.

We’ve studied this pattern thousands of times, with firms across all 50 states.

Now any firm, regardless of size, can follow this pattern and take back control of their engagements.

Key Elements of the Checklist

The Client Fit Checklist© has 3 specific elements you’ll need to test a client’s fit:

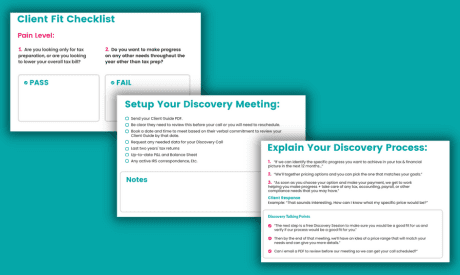

- Diagnose The Client’s Pain Level

- Describe Your Discovery Process

- Setup Your Discovery Meeting

Let’s break down each element.

1. Pain Level

The first step of the test is to gauge the client’s current pain level.

You do this by asking two simple questions:

- Are you looking for a tax return or are you looking to lower your overall tax bill?

- Do you want to make progress on any other needs throughout the year other than tax preparation?

Why do we focus on the client’s pain level?

You obviously don’t wish pain on any person.

From a business perspective, the more discomfort someone is in, the more motivation they’ll have to cure the issue causing this discomfort.

For most Americans, getting their taxes done can be uncomfortable, but they know there are many options to solving that problem.

If the client only wants simple tax preparation, they are trying to solve a less painful issue in their life. Simple tax prep = lower pain and lower fee.

Contrast tax preparation with trying to strategically lower their tax bill.

If someone feels like they’re paying too much in taxes and they don’t have enough cash left over to fund their retirement, travel, save for education, or invest in their business, this is a much higher level of pain they’re experiencing in life.

Tax planning = Higher pain and higher motivation.

Higher motivation = More meaningful engagements with a higher fee.

The same goes for only wanting help with tax preparation without any other bundled services.

Only wanting help with tax prep = lower pain and lower fee.

Help with other needs throughout the year = higher pain and higher motivation.

These can be things like accounting, strategic advisory planning, payroll/HR support, tax resolution help, etc.

Higher motivation = More meaningful engagements with a higher fee.

The two simple “test” questions above:

- Immediately put you in the driver’s seat as the “advisor”.

- Immediately separate you from other firms they might be speaking to.

- Give you a quick way to quantify if you want to work with this person.

If they “pass” with answers that align with the types of clients you want to work with, then you move forward with the conversation.

If they fail, you end the call and save everyone the heartache and frustration.

So what happens if they pass?

2. Explain Your Discovery Process

If you determine this is someone you want to work with, then you’ll need to make the next steps in your process clear.

- “If we can identify the specific progress you want to achieve in your tax & financial picture in the next 12 months…”

- “We’ll put together pricing options and you can pick the one that matches your goals.”

- “As soon as you choose your option and make your payment, we get to work helping you make progress + take care of any tax, accounting, payroll, or other compliance needs that you may have.”

The client will then usually say something like:

- “That sounds interesting. How can I know what my specific price would be?”

You could say something like:

- “The next step is a free Discovery Session to make sure you would be a good fit for us and verify if our process would be a good fit for you.”

- Then by the end of that meeting, we’ll have an idea of a price range that will match your needs and can give you more details.

- Can I email a PDF to review before our meeting so we can schedule your call?”

This leads us to the final step…

3. Setup Your Discovery Meeting

A critical step that many firms miss, is sending the client a document to review before you have your Discovery Meeting.

This document should include 6 data points:

- What basic levels of service can they choose from?

- How can they know which option is the best for their unique situation?

- The best times of year to choose an option.

- Why should they work with you over other firms?

- The starting price ranges for your primary levels of service.

- The logistical next steps for how to get started.

We call this type of document your firm’s Client Guide.

See our blog on Creating a Client Guide for Your Practice here.

When you send a client a document like this before your initial Discovery Meeting:

- You test and see if they’re willing to invest in making the meeting successful (like you are).

- You let them see a fee range before your call so they have a chance not to waste time in a meeting if your price range is unpalatable.

- You show them you really care about the outcomes you provide because you’re a true professional.

- By the time you have the Discovery Call with the client, you’re no longer “selling”, you’re simply listening to which level of service they’re interested in and why, and verifying if it’s a good fit.

When you don’t prepare the client for your Discovery Meeting:

- The client has no idea what to expect so they could be defensive during the call thinking they’re going to be “sold” to.

- You don’t know if they’re serious about partnering with your firm for the long term so you could be wasting your time on the call.

- They’ll just be comparing your services to every other tax prep option because you haven’t educated them as to why you’re different.

The last step in the process is holding your Discovery Meeting with the client.

You can access full training on Discovery Meeting best practices here.

Next Steps

You don’t have to implement this on your own…there are two ways we can help.

- Click below to download – Our FREE Client Fit Checklist ©

2. If you want to fully automate this process in your practice, but don’t have the time to do it yourself. Check out the SmartPath Engage software that will do 99% of the work for you.

(Learn more here.)

William Hamilton is the Founder of SmartPath.co

Over the last 14 years, we have helped 1,000’s of Tax Pros perfect their pricing and increase their margins so they can focus on work they enjoy.