How to Find the Perfect Price for Any Tax Client

Picking a “fair” price for a client is stressful.

If you’re like many of the small firm owners we work with –

- You want to be paid what you’re worth but hate the thought of upsetting clients.

- You’re not sure the best way to answer, “How much do you charge?”

Or “Why is my price going up?” - You want better margins but sometimes it feels like you’re losing your shirt by the time you deliver all your work.

If any of these thoughts resonate, you’re not alone.

8 out of 10 small firm owners report struggling with pricing their services.

What Happens With the Right Pricing Strategy?

- ✅ You can be paid what you’re uniquely worth.

- ✅ You can increase your margins.

- ✅ Easily give clients a price that makes sense and they’ll be happy to pay.

- ✅ Streamline your pricing process so anyone in the firm can quote for you.

We want to give you the Perfect Pricing Template©.

We’ve worked with 1,000’s of tax & accounting professionals for over 14 years helping them implement better pricing.

Data shows any firm regardless of size, whether they’re an EA, CPA, or Register Preparer, can follow this template and make their pricing easier and more profitable.

How to Find the Perfect Price

The Perfect Pricing Template© has three specific steps to reveal the perfect price for any client:

- Define

- Calculate

- Customize

Let’s dive in.

1 | Define

Can you know how much a client is willing to pay before giving them a proposal?

Many firms gather this information and it gives them a significant competitive advantage.

They never give clients a proposal without knowing how much they’re willing to spend first.

The amazing thing is, clients will tell you if you ask in the right way.

There are 5 major categories of client value:

First Category -Setup Help (Helping someone set up their Quickbooks or S-Corp)

Second Category – Expert Historic Work (Tax Prep or Accounting Reconciliation)

Third Category – Done-For-You Management (Accounting, Payroll, or helping with IRS Issues)

Fourth Category – Tax Reduction Planning (Strategic Tax Planning, Reasonable Comp Analysis, etc.)

Fifth Category – Better Results Planning (Cash flow analysis, budgeting, business advisory, etc.)

By asking the client two simple questions:

- What progress do you want to make in your business or financial life in the next 12 months?

- What impact will that progress have in your life?

You can then start to build a list of services the client would be willing to pay for.

Ex: “One thing you mentioned is wanting to lower your taxes. If we identify you could lower your tax bill by converting to an S-Corp and starting payroll…do you want to manage your payroll yourself, or would you rather we take care of that for you through our Payroll partner? That way you can focus on growing your business…”

Once you verify the services the client wants help with, you’ll now have a list of items they’re likely willing to pay for.

- Not every type of progress a client wants will lead to a service you want to offer.

- Not every type of progress a client wants will lead to a service they want to pay for.

The key is to identify the top 3 results that have the most impact on their life, and then build your price around that.

We have full training on how to structure your Client Discovery calls.

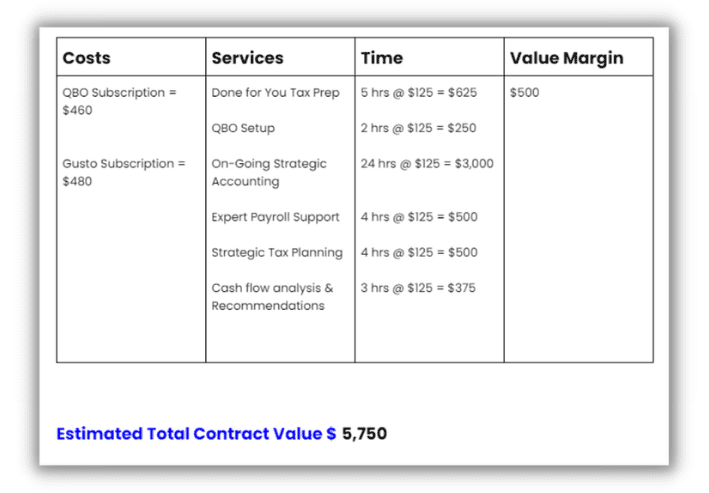

2 | Calculate

Now you can actual numbers around those services so you can identify a price range that will lead to a fair profit margin for you.

For each category of value, calculate:

- Hard Costs

Are there any hard costs you’ll need to pay, or pass on to the client to deliver this value? Examples:

- QuickBooks subscriptions

- Payroll/HR Platform subscriptions

- Industry-specific software

- 3rd Party Expert fees

Costs like your tax software or office expenses are carried by your entire client base, so these costs wouldn’t be specific to a client when it comes to calculating a price.

Example:

- QBO Subscription = $460

- Gusto Subscription = $432

- Legal Inc Entity Formation = $1,050

- Total Hard Costs = $1,952/Year

- Services

- Tax Preparation (Expert Historic Work)

- On-Going Strategic Accounting (Done-for-You Management)

- QuickBooks Setup (Setup Help)

- Strategic Tax Plan (Tax Reduction Planning)

- Cash Flow Analysis & Recommendations (Better Results Planning)

Packages

These services will make up the “package” the client is likely willing to pay for because this is the help they wanted.

These services will have a higher value than a list of services that have been pre-bundled into “Silver”, “Gold”, & “Platinum” packages that don’t align with their needs.

- Time

Next, you can estimate how much time it will take for you to provide these specific services throughout the year:

- Tax Preparation = 5 hours

- QuickBooks Setup = 2 hours

- On-Going Strategic Accounting = 24 hours

- Expert Payroll Support = 4 Hours

- Strategic Tax Planning = 4 hours

- Cash Flow Analysis & Recommendations = 3 hours

Total: 42/Year

You’re not going to show the client these hours or base the entire fee on them.

You do need an idea of how much time delivering these services will take.

Once you have your total, multiply those hours by a strategic rate that you feel is appropriate for this client’s complexity, ease of working with them, and capacity share they’ll be using.

The example above > 42 hours x $125/hr = $5,250

- Value Margin

This is the pure profit you deserve to make based on:

- The complexity of helping them achieve their top 3 priorities.

- How organized their data is.

- How easy do you estimate it will be to work with them?

- How much of your unique expertise and experience will you apply to their situation?

- How much capacity they’ll be taking away from other potential engagements?

This is a whole number that can be different for each client.

This is a number you could increase significantly if it’s a tough client.

Or you could decrease it to zero if it’s a friend or family member.

- Example Above = $500 Value Margin

3 | Customize

The last step is to Customize the terms of the Engagement to match the client’s needs.

- Does this client have custom needs that would impact how and when they need to pay?

- Does this client have custom needs that would increase their overall fee?

- Is there a payment term that would make the most sense?

- Upfront fees

- Monthly Billing

- Quarterly Billing

- Annual Billing

- Contract Period

Bringing it All Together

Once you complete all three steps, you’ll have the Perfect Price for any client that will look something like this:

Once you have the estimated total contract value, you can break that value into options or terms the client can choose from:

First Option = $5,750 Upfront

Second Option = $1,500 upfront + $354.16/month

Third Option = $479/month

- Using The Perfect Pricing Template© will finally give you a holistic view of how much you should charge to help this client throughout the year.

- Because this price specifically matches the unique progress this client wants to achieve, the likelihood of them engaging is very high.

Quick Review

To find the perfect price for any client:

- Define what specific progress they want to make in their lives or business using the 5 Categories of Client Value.

- Calculate the hard costs, services, time, & value margin needed to help them make that progress.

- Customize their terms and options based on their needs.

Next Steps

You don’t have to implement this on your own…there are three ways we can help.

- If you want to fully automate the pricing process in your practice, but just don’t have the time to do it yourself. Check out the SmartPath Engage software that will do 99% of the work for you. (Learn more here.)

William Hamilton is the Founder of SmartPath.co

Over the last 14 years, they have helped 1,000’s of Tax Pros perfect their pricing so they can focus on work they enjoy.